Pag-Ibig Housing Loan - Low Interest, High Approval Up to 6M with 30 Years Term Payment and Easy to Apply Online

Pag-Ibig housing loan is a great way to get your dream home. Thru the HDMF loan program for Filipinos, it is now easier and cheaper to buy a property, do some home repair or finance a new house construction. This type of secured loan is offered to all qualified Pag-Ibig members.

Reminder: There is a latest discount promo for members looking to avail of the Pag-Ibig Housing Loan program. You can see the latest and updated low interest rate promo poster below which runs only until December 29, 2020.

How to Qualify for Pag-Ibig Housing Loan?

We have listed the different qualification criteria below for your guidance. Pag-Ibig Fund now allows the inclusion of cost for the transfer of ownership of property for those who are availing of the purchase of brand new condo or house or a mortgaged property from repossessed assets list of Pag-Ibig. The 5 different purposes are listed below.

- Active member with least 24 months savings

- Borrower must not be more than 65 years old at the date of the loan application and is not more than 70 years old at the date of loan maturity

- Legal capacity to acquire and encumber real property

- No Pag-IBIG housing loan that is foreclosed, cancelled, bought back, or voluntarily surrendered

- If with existing Pag-IBIG Housing account or Short Term Loan (STL), payments must be updated

Downloadable Forms for Pag-Ibig Housing Loan

You can download the list of housing loan forms depending on your case as a borrower of Pag-Ibig. Please visit this site.

- Housing Loan Availment

- Application for Home Rehabilitation Housing Loan Program

- Loan Term Adjustment

- Conversion to Full Risk-Based Pricing Model

- Application for Moratorium on Housing Loan Payments

- Plan of Payment for Defaulted Housing Loan Accounts

- Housing Loan Restructuring/Penalty Condonation

- Non-Performing Assets Resolution Program (NPARP)

- Application for Insurance Claim

- Application for Non-Life Insurance

- Accreditation of Agency/Company - Collection Agency

- Purchase of an Acquired Asset

- Rent-to-Own Program

6 Different Purposes of Pag-Ibig Housing Loan

As what I have learned from attending financial literacy seminars. All financial move must have a goal. Without one, the financial foundation will crumble. Therefore, just like what it says, a Pag-Ibig housing loan must have a purpose. Below is the specific list that your scenario may fall in to. please be reminded that today, the cost of transfer of ownership is already included in the processing of your housing loan with Home Development Mutual Fund.

- Purchase thru Pag-Ibig accredited developers

- Purchase (plus cost of transfer) of residential lot or adjoining residential lots (max 1,000 sq.m.) -

- Purchase (plus cost of transfer) of residential house & lot, townhouse or condominium unit (old or brand new, property mortgaged w/ the Fund, adjoining houses/units) inclusive of a parking slot

- Construction of house / Improvement of house

- Refinancing of an existing housing loan

- Combined Loan Purposes

Requirements in Applying for Pag-Ibig Housing Loan

We have the list of requirements in applying for Pag-Ibig housing loan if you are the seller, the buyer or borrower or if you are self-employed, locally employed and for OFWs or overseas Filipino workers.

Allowed IDs in Applying for HDMF Housing Loan

|

|

- Notarized Developer’s Sworn Certification (HQP-HLF-062)

- Transfer Certificate of Title (TCT)/Condominium Certificate of Title (CCT) with Deed of Assignment of CTS with SPA (With Buyer’s Conformity) duly annotated thereon (photocopy)

- Updated Tax Declaration and Updated Real Estate Property Tax Receipt (photocopy)

- TCT/CCT with Deed of Assignment of CTS with SPA (With Buyer’s Conformity) duly annotated thereon (Owner’s Duplicate Copy)

- Mortgage Documents a. Notarized Deed of Assignment of CTS with SPA (With Buyer’s Conformity) duly registered with Registry of Deeds and bearing the original RD stamp (HQP-HLF-523) b. Contract-to-Sell (HQP-HLF-161) c. Duly accomplished/notarized Promissory Note (HQP-HLF-086/087) d. Pre-signed Deed of Absolute Sale (HQP-HLF-525) e. Pre-signed Disclosure Statement on Loan Transaction (HQP-HLF-085) f. Pre-signed Loan and Mortgage Agreement (HQP-HLF-162/163)

- Notarized Certificate of Acceptance (HQP-HLF-083)

- Borrower’s Validation Sheet (HQP-HLF-058)

- Documentary requirements submitted during the advance evaluation and technical inspection (Refer to Item I).

REQUIREMENTS FROM BORROWER: (including for technical appraisal)

- Housing Loan Application with recent ID photo of borrower/co-borrower (if applicable) (2 copies, HQP-HLF- 068/HQP-HLF- 069)

- Proof of Income

- One (1) valid primary ID (photocopy, back-to-back) of Principal Borrower, Co-Borrower, and Developer’s Authorized Representative and Attorney-In-Fact, if applicable. The same ID must be presented during the conduct of borrower’s validation.

REQUIREMENTS FOR DEVELOPER: (including for technical appraisal)

- Letter Request for Advance Evaluation and Technical Inspection

- Softcopy of Borrower’s Profile

- Transfer Certificate of Title (TCT)/Condominium Certificate of Title (CCT) in the name of Developer or land owner, in case of Joint Venture.

- Updated Tax Declaration and Updated Real Estate Tax Receipt (photocopy)

- Pag-IBIG Fund Receipt for payment of Processing fee (photocopy)

Requirements For Locally Employed, Self-employed or Overseas Filipino Workers (OFW)

- One (1) valid ID (Photocopy, back-to-back) of Principal Borrower and Spouse, Co-Borrower and Spouse, Seller and Spouse and Developer’s Authorized Representative and Attorney-In-Fact, (if applicable)

REQUIREMENTS FROM SELLER (and/or BORROWER):

- Transfer Certificate of Title (TCT) (latest title, Certified True Copy). For Condominium Unit, present TCT of the land and Condominium Certificate of Title (CCT) (Certified True Copy).

- Updated Tax Declaration (House and Lot) and Updated Real Estate Tax Receipt (photocopy)

- Vicinity Map/Sketch Map leading to the Property subject of the loan

FOR PROOF OF INCOME:

For Locally Employed, ANY of the following:

- Notarized Certificate of Employment and Compensation (CEC), indicating the gross monthly income and monthly allowances or monthly monetary benefits received by the employee

- Latest Income Tax Return (ITR) for the year immediately preceding the date of loan application, with attached BIR Form No. 2316, stamped received by the BIR

- Certified One (1) Month Payslip, within the last three (3) months prior to date of loan application

NOTE: For government employees who will be paying their loan amortization through salary deduction, the Certified One (1) Month Payslip, within the last three (3) months prior to date of loan application, must be submitted together with CEC or ITR.

For Self Employed, ANY of the following Proof/s of Income:

- ITR, Audited Financial Statements, and Official Receipt of tax payment from bank supported with DTI Registration and Mayor’s Permit/Business Permit

- Commission Vouchers reflecting the issuer’s name and contact details (for the last 12 months)

- Bank Statements or passbook for the last 12 months (in case income is sourced from foreign remittances, pensions, etc.)

- Copy of Lease Contract and Tax Declaration (if income is derived from rental payments)

- Certified True Copy of Transport Franchise issued by appropriate government agency (LGU for tricycles, LTFRB for other PUVs)

- Certificate of Engagement issued by owner of business

- Other document that would validate source of income

For Overseas Filipino Workers (OFW), ANY of the following:

- Employment Contract

- Employment Contract between employee and employer; or POEA Standard Contract

- Certificate of Employment and Compensation (CEC) - CEC written on the Employer/Company’s official letterhead; or CEC signed by employer (for household staff and similarly situated employees) supported by a photocopy of the employer’s ID or passport

- Income Tax Return filed with Host Country/Government

NOTE: If documents are in foreign language/s, English translation is

required.

Additional Requirements

(if applicable only): Collection Servicing Agreement with Authority to Deduct Loan Amortization or Post Dated Checks For OFW members

For OFW Members:

Special Power of Attorney (SPA) notarized prior to date of departure. For OFW member abroad, a SPA notarized by a Philippine Consular Officer, or SPA notarized by a local notary (of the country where the member is working) but duly authenticated by the Philippine Consulate.

The Fund may also require ANY or a combination of the following documents:

- Payslip indicating income received and period covered

- Valid OWWA Membership Certificate

- Overseas Employment Certificate

- Passport with appropriate visa (Working Visa)

- Residence card/permit (permit to stay indicating work as the purpose)

- Bank remittance record

- Professional License issued by Host Country/Government

NOTE: If documents are in foreign language/s, English translation is required.

Insurance Coverage:

a. Health Statement Form (Medical Questionnaire)

✓ For borrowers over 60 years old

✓ For borrowers up to 60 years old, if loans is over P2.0 M to P6.0 M

b. Health Statement Form (Medical Questionnaire) and Copy of the result

of medical examination conducted prior to assignment overseas as

required by the employment agency

✓ For OFW borrowers over 60 years old

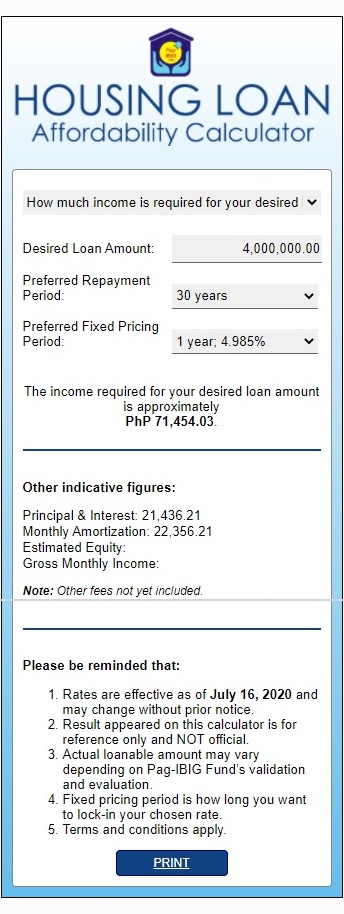

Housing Loan Affordability Calculator

For the Pag-Ibig affordability calculator, you can compute and come up with 3 specific figures. You can base your housing loan application from the results.

Below are the 3 criteria. (see figure beside).

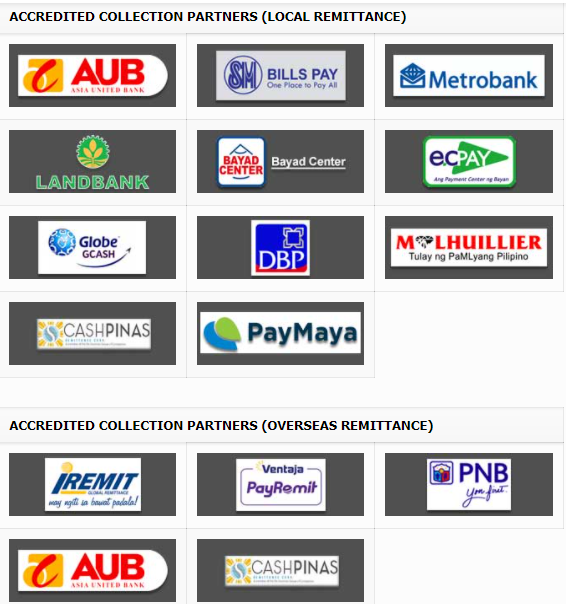

We have also provided the list of different payment center partners for local and overseas remittance (for OFWs) of Pag-Ibig Fund below for your reference especially for paying members who already have their housing loan.

1. How much income is required for your desired value?

2. How much you can borrow based on your income?

3. How much you can borrower based on the value of the property?

(see sample computation image with a 4M housing loan)

Modes of Payment for Pag-Ibig Housing Loan

- Salary deduction through Employer Collection Servicing Agreement (CSA)

- Post-dated checks

- Payment to an accredited Developer with CSA with the Fund

- Auto debit arrangement with banks

- Accredited collection partners» Local Remittance» Overseas Remittance

Collaterals and Loan Limitations

COLLATERALS

Clean Title (TCT/OCT/CCT)

Not accepted as collateral:

- “Rights”

- Free Patent not covered by RA10023

- With disputes, claims in the court

LIMITATIONS

- Less than 28 sq. m. lot area

- Less than 18 sq. m. condominium floor area

- Properties with road right of way less than 1.5 meters

- Land types classified other than residential use.

Advisories for Pag-Ibig Housing Loan Borrowers

As mandated by R.A. 9510 pr the Credit Information Systems Act (CISA), the Pag-IBIG Fund is required to submit its housing loan borrower's Basic Credit Data and other credit information to the Credit Information Corporation (CIC).

CISA aims to address the need for a comprehensive, centralized and reliable credit information system, thereby establishing the creditworthiness of the borrower.

All data submitted to the CIC shall be covered by strict confidentiality and shall be used only for the declared purpose of the Act.

5 Steps in Applying for Pag-Ibig Housing Loan

We have enumerated the different step-by-step process in applying for a Pag-Ibig housing loan below. Please be guided accordingly.

- Get the checklist of complete requirements and comply

- Download, fill up and submit the housing loan application

- Receive the notice of approval (NOA) and letter of guarantee (LOG)

- Accomplish the NOA requirements for the release of loan proceeds

- Receive loan proceeds at the Pag-Ibig Fund

Overseas and Local Accredited Payment and Remittance Partners for Paying your Pag-Ibig Housing Loan

Whether you are an OFW or a Philippines based worker, there is always a way for you to pay your Pag-Ibig Fund membership premiums and housing loan amortization. Please use the guide below for your reference of the list of banks and payment centers that HDMF is affiliated with. You can use these payment gateways at your preference.

Authorized Local Remittance Collecting Partners

- Asia United Bank

- SM Bills Pay

- Metrobank

- ECPay

- Bayad Center

- Landbank

- GCash

- Development Bank of the Philippines

- M Lhuillier

- PayMaya

- CashPinas

Authorized Overseas Remittance Collecting Partners

- iRemit

- Ventaja PayRemit

- PNB

- Asia United Bank

- CashPinas

By now if you are ready to get your dream house / home, please consider taking up a good financial advisor service advice. Otherwise, you can learn kung paano palaguin ang pera sa pamamagitan ng investment options na matututunan mo sa aming FREE Financial Literacy Course.

Recent Articles

-

Learn Loan Redemption Insurance? How Does it Work for Loan Borrowers?

Oct 04, 20 12:05 AM

Getting a loan? Learn first how loan redemption insurance works and what it means for loan borrowers. Also what is the process to avail? -

Pag-Ibig Housing Loan - Affordable Shelter for Filipinos thru HDMF

Oct 03, 20 06:37 AM

Build your dream home with Pag-Ibig housing loan program. Affordable, long term, low interest rate, easy 6 step application thru HDMF application. -

Pag-Ibig Loan - HDMF Housing and Salary Loan or MPL

Sep 26, 20 06:53 AM

How to apply for Pag-Ibig Loan and HDMF's house financing program and the salary loan or MPL terms and interest. Avail online application now!