What is Loan Redemption Insurance? How Does it Work for Loan Borrowers and How to Avail?

Ano nga ba ang loan redemption insurance or mortgage redemption insurance? Yung iba ang tawag dito ay credit life insurance. Iba iba po ang tawag pero iisa lamang ang gamit nito. It works for the benefit of the insured and the beneficiary dependent on what happens to an insured person as attached to his or her credit or loan.

Be definition, loan redemption insurance is actually a type of life insurance attached to a personal non collateral loan or a secured / collateral loan. This works for the insured person who had a loan with a bank, a financing company or a lending company (lender). The loan redemption insurance is attached to the loan. This acts as a protection to the beneficiary in case the insured dies. In cases where a disability occurs, the same insurance works. The only difference is that the insured lives and will be the one to redeem or claim the insurance.

What is the Importance of a Loan Redemption Insurance?

The importance of a loan redemption insurance is that it helps give the insured or his/her dependents of beneficiaries protection. This protection is in terms of paying a loan in full in an event the insured dies or is rendered disable.

Basically, this works just like life insurance. The only difference is that LRI or mortgage redemption insurance is attached to a loan or mortgage either a house or a car or vehicle as collateral. Others may call it credit redemption insurance in a case where personal or unsecured loan is availed by the insured.

How Does Loan Redemption Insurance Work?

LRI works in times where anything happens to the insured. Loan redemption insurance also helps the beneficiaries or dependents to avoid distress selling of assets or collateral. This distress selling is also called as rush sale to avoid further bad financial impact to the ones left behind or in case the insured gets disabled.

Loan redemption insurance also helps assure the beneficiaries or dependents get an assurance that they will have a home to stay. This is in case the insured or breadwinner dies or gets permanently disabled and cannot afford to work to pay for the housing loan. This means that the loan gets fully paid and the asset will go to the beneficiary or dependent.

2 Types of Loan Redemption Insurance

- Level Mortgage Redemption Insurance - The same yearly premium is to be paid by the insured. Here, the premium is higher while the payout amount is constant all throughout the loan payment duration. But if anything happens due to disability or death. the full amount is redeemable. For example, the insured amount is 3M and you were able to pay for 1M in 1 year, then something happens and you die or gets disabled, this means that you still get 3M insured amount and pay only 2M to the financial, lender or lending institution. The remaining 1M goes to your pocket or to your beneficiary or dependent in case of death of the insured or breadwinner.

- Declining Mortgage Redemption Insurance - Bumababa ang payout while the loan gets paid in time. Ex. if you have 3M loan. after a year 1M gets paid. This means that 2M will be left in your principal loan. This also means that your MRI will also decline or is lower. This is the cheaper type and is more advisable to get in our opinion here at Fast Loan Philippines.

Take note that claim payout is a very important consideration. Read the time print of your contract to avoid losing money. There is a chance that your contract might have the claim payout to go fully to the lender or lending or financing company. You should make sure that part of the insurance claim will go to the dependent of beneficiary. This is because you can use this fund to augment to pay for the loan and whatever in excess will go to the beneficiary or dependent.

What Happens to the Claim If the Insured Do Not Die or Gets Disabled?

Just like when you are to travel from point A to point B, if you paid transportation cost to arrive to point B, it means that your payments is already used.

The same thing works for insurance. Paying for premiums is not redeemable if you do not die or do not get disabled as part of the agreement. Be thankful that you did get to your destination without any hazzards. Therefore, the premiums you paid is as good as paid as an expense to the insurance company.

This is where the company earns from just like any other services company. Insurance is for you and your assets protection. You pay for their respective insurance and in case of no claim, it means you should be thankful you either did not die or got disabled.

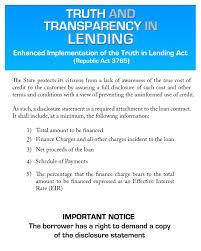

What to Remember in Terms of Truth In Lending Act

Basically truth in lending act works for the benefit of the loan borrowers. Here, the lending company, financing institution or bank must disclose all charges and where these charges go.

Non disclosure is punishable by law and if you ever encounter this type of scenario, please report to the right government agency or ask for a legal advice.

Recent Articles

-

Learn Loan Redemption Insurance? How Does it Work for Loan Borrowers?

Oct 04, 20 12:05 AM

Getting a loan? Learn first how loan redemption insurance works and what it means for loan borrowers. Also what is the process to avail? -

Pag-Ibig Housing Loan - Affordable Shelter for Filipinos thru HDMF

Oct 03, 20 06:37 AM

Build your dream home with Pag-Ibig housing loan program. Affordable, long term, low interest rate, easy 6 step application thru HDMF application. -

Pag-Ibig Loan - HDMF Housing and Salary Loan or MPL

Sep 26, 20 06:53 AM

How to apply for Pag-Ibig Loan and HDMF's house financing program and the salary loan or MPL terms and interest. Avail online application now!